Reblogged from my Integral Permaculture site.

National Public Radio’s “Morning Edition” reported this morning:

NPR’s Business News starts with the outlook for oil. This is a change of course – the International Energy Agency has released a report on global energy investment. And this group predicts the United States will have to rely more heavily on Middle East oil in the coming years, as North American sources start to dry up a little bit. U.S. energy production has boomed recently, much of it coming from oil and gas extracted from shale. But the IEA says U.S. production will start to lose steam around 2020, and that would put more bargaining power back in the hands of OPEC countries, such as Saudi Arabia.

This is quite interesting, given that in 2012, the IEA forecast that the U.S. would overtake Saudia Arabia in oil production by 2020, and that North America would be a net oil exporter by 2030. The International Energy Agency (I.E.A.) is a watchdog organization considered the world’s leading energy analyzing institution. This new stance coincides with a similar about-face from the U.S. government’s EIA (Energy Information Administration), which suddenly downgraded its assessment of the Montery Shale “tight oil”....

Well, that Shale bubble, didn’t last long, did it? As Sylvia says, “we told you so!” One of the best recent analysis of the current energy situation, I believe, was done by Steven Kopits, which I wrote about here. and with a follow-up here.

The focus of the new report released by the IEA today is on how much investment in the energy sector is going to be needed in the next 20 years (World Energy Investment Outlook). The numbers are sobering. They estimate that $48 trillion dollars needs to be invested to meet energy needs…but really it needs to be closer to $53 trillion if we want to address climate change. They don’t even bother talking about a 350 parts per million target, but rather 450 parts per million to limit global warming to 2 degrees C.

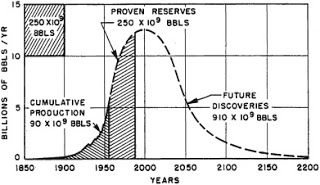

I am extremely skeptical that even these levels of investments would provide the levels of energy the world is expecting. The IEA is becoming increasingly more realistic as they move beyond demand driven scenarios, and acknowledge that the era of easy oil is over. The alternatives we are left with are becoming increasingly expensive – from unconventional fossil fuels like tar sands and shale plays, to renewables. However, at some point (a point we may have already passed), geology responds less and less to the human construct we call money. We’re currently living at the high point of the fossil fuel Pulse, and I don’t believe we can negotiate an avoidance of the backside of the pulse’s decline – but we can take measures to make a graceful descent if we begin early enough (ten years ago).

The report itself (disclaimer: so far I’ve only looked at the accompanied introduction, fact sheet, and powerpoint) notes many risks and difficult achievements that will be necessary. To note just a few:

- The middle east may or may not increase oil supply.

- Depletion of conventional fossil fuels force reliance on more challenging fields which puts pressure on upstream costs.

- The larger share of the trillions in investment would go just toward replacing existing production that is in decline, and not toward demand growth.

- Nearly two-thirds of the investment will take place in emerging economies in Asia, Africa, and Latin America.

- There are many political and regulatory uncertainties that will be difficult to navigate.

- Financing the transition to a low carbon energy system is a major challenge (to put it mildly).

- Getting the world to a 2 degree emissions path would mean a different investment landscape (and a breakthrough at the Paris 2015 COP).

- Households need to make about half of the investment, with 40% coming from business, and 11% from government.

- “The supply of long term financing on suitable terms is still far from guaranteed” – “the banking sector…may be constrained…in the wake of the financial crisis.” (to put it mildly)

This last bullet point above reminds us of the difficult bind we are in. Many of us believe we are teetering on the edge of an even bigger financial crisis, which would not only make the above investments impossible, but will lead to a steep decline in existing investments. Even now we are seeing signs of this.

On that happy note, below is IEA Executive Director Maria van der Hoeven’s remarks at the launch of the report.

To read an introduction to the World Energy Investment Outlook, please click here.

To download World Energy Investment Outlook, please click here.

To download Executive Director Maria van der Hoeven’s remarks at the launch of the report, please click here.

To download the presentation at the launch of the report, please click here.

To download fact sheets related to the report, please click here.

Comment

© 2025 Created by David MacLeod.

Powered by

![]()

You need to be a member of Transition Whatcom to add comments!

Join Transition Whatcom